Stock market is a volatile place. You can never be sure about the exact outcome, unless you bear the power of seeing the future. While everything might seem normal, things can take a 180* turn and become bad or vice versa. In such cases, it is very important to make a balanced approach towards investing. The risk ought to be calculated so that you do not get exposed to high market radiation, and stay safe for long.

ABSL Equity Hybrid 95 Fund is an important selection for your investment cart, if you desire safety without compromising on growth. This fund has been serving in the Indian market for more than two decades, and has become one of the most subscribed hybrid funds in India. It is perfect for anyone who is looking forward to make a profitable plan, without getting exposed to too much risk. There are various advantages and features associated with investing in Aditya Birla Sunlife Equity Hybrid 95 Fund, the best of which have been jotted down below in the article. So, don’t go anywhere for the next ten minutes, and stay glued to your device’s screen.

The Background Check

Aditya Birla Sunlife Equity Hybrid 95 Fund (G), erstwhile Aditya Birla Sun Life Balanced 95 Fund), is an equity-oriented hybrid fund launched in February, 1995 specifically for the Indian customers. The aim of this fund is to generate long term capital growth and stable income over the course of the investment, through a portfolio consisting of equity, debt and money market instruments. Through this approach, it aims to provide a platform to all the investors of making a balanced and systematic investment, geared towards achieving their goals and objectives.

Why Should You Invest in this fund?

There are many reasons that make an investment in Aditya Birla Equity Hybrid 95 Fund a favourable choice for your portfolio. For the sake of brevity, some of the strongest points have been jotted down below for you. Have a look: -

1.Steady Mix of Equity and Debt

Since ABSL Equity Hybrid 95 Fund is an equity-oriented hybrid fund, it contains of both equity and debt. While the former provides necessary energy to grab higher returns from the market, the latter adds stability to the portfolio preventing it from getting succumbed to the market volatility.

2.Steady Cash Flow

One of the best things attached to investing in Aditya Birla Sun Life Equity Hybrid 95 Fund – Regular Plan (G) is the steady inflow of cash. The fund has produced marvellous returns in the past, which has made it one of the most favourable choices in the market. As per the record, the past five year returns stand at 19.86%, way above the benchmark returns of 16.55% and that of the category average of 18.60%.

3.Diversification Benefit

The presence of equity and debt is a killing combination. Together they infuse great energy to the portfolio making it ready for taking up the later challenges placed in front by the market. The mix of equity and debt pours in diversification to the portfolio, thus making it more powerful than ever to perform better for longer.

What does the Portfolio of the Fund Contain?

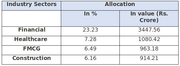

As you might have learned by now that there is a presence of both equity and debt, it is important to have a further knowledge of the inner division of these two capital flavours. The equity has been given 2/3rd space in the portfolio with 75.31%, while the debt and cash are present in relatively lower percentages standing at 21.45% and 3.24%, respectively. Down the line, these assets have been dissected into many growing industries. Let’s take a quick glimpse of the industries involved in making the portfolio of Aditya Birla Sunlife Equity Hybrid 95 Fund (Growth): -

So, if you are planning to make an investment in mutual funds and are in the search of a worthy plan, then your search ends here. Invest in ABSL Equity Hybrid 95 Fund and enjoy lifelong fruitful results.

The article is written with an aim to create awareness amongst the investors regarding the best possible investment solutions available to them in the contemporary market. Aditya Birla Sunlife Equity Hybrid 95 Fund (G) is a superb solution for all, regardless of the individual profiles. One must take advantage of this fund in a way that is best suited to him and for that, one may take the help of a financial consultant, or the holy place of all answers, Google.

The author is a Chartered Accountant. She provides financial consultancy and also handles tax related cases. Apart from these jobs, She also write articles on various topics of finance for top financial companies, such as MySIPonline.

Post new comment

Please Register or Login to post new comment.