Mobile wallet applications have consistently been the most blazing topic since the worldwide versatile instalment income outperformed $780 billion in 2017, and specialists foresee that it will cross 1 trillion by 2019. This reality demonstrates that this might be the best ideal opportunity for your e-wallet startup.

We expect 36.3% of mobile phone users in 2019 to make an in-store mobile payment at least once in every six months. When there is such a massive inflow of mobile transactions, every user needs a payment mode that is safe storage for them. This is how the idea of a mobile wallet app came in place.

Mordor Intelligence did research and revealed that the Digital payment market was estimated at $1449.57 billion in 2020. They also stated that by 2026 the market will expand with a compound annual growth rate (CAGR) of 24.50% over the prophecy to reach $5399.60 billion. Adaptation and integration of mobile payment apps like PayPal, Samsung Pay, WeChat Pay, and AliPay is rapidly increasing across the globe between bricks and mortar stores to acquire digitization.

Not only mobile devices that have become part of every individual’s life, the Internet has also become vital. Companies started investing in E-Wallet technology, owing to significant growth in the industry.

Many people utilizing instant payment capabilities through their smartphones, many retailers have started focusing on enabling cashless payments and providing benefits to uplift users to pay by using digital payments mode.

Industry Regulations

As there are several regulations, it is not that easy or simple to be compliant with FinTech regulations. It is a must for every FinTech company to follow. In every country, mobile wallet compliances are different.

Compliances for particular countries are also there in the market, you'll also have to comply with Payment Card Industry (PCI) security standards that apply in the market.

Also Read: Fintech Business Compliances - An Overview

Mobile Wallet Software Development Kit

Here I am explaining several different types of Software Development Kits (SDKs) that can help you implement payment functionality into your e-wallet apps.E-Wallet development requires extraordinary efforts in terms of third-party services integration. . So, don't misinterpret Software Development Kits with a premade platform. SDKs always try to make your job a bit easier.

PayPal Mobile SDKs

PayPal's SDKs permit developers to make wallet apps for both the platforms iOS and Android. These SDKs come from the explorer of mobile payments, PayPal. The GitHub iOS documentation for this SDK is available here, whereas for android visiting here.

As mentioned above, FinTech regulations are different for every country. Braintree is ok to be used in some countries, while for some countries, PayPal provides an alternative method - PayPal Native Checkout SDK.

Other Mobile Wallet SDKs

1. Simplify Commerce Mobile SDKs

2. Mastercard Mobile Payment SDKs

3. Razorpay Mobile SDKs

4. QuickPay Mobile SDKs

Cloud

Security plays a vital role in E-Wallets. You have to make sure that the data should only remain within the country borders. As mentioned above, the FinTech industry is highly regulated, and the regulations are used differently in every country; hence the regulations depend on the nation you want to operate in.

Best cloud service providers are listed below:

1. IBM Cloud

2. Google Compute Engine

3. Digital Ocean

4. Rackspace

Hosting of Your Mobile Wallet Backend

Now, let's talk about the development of a mobile app wallet. It is important to understand the hosting of your mobile wallet app's backend. We at Nimble AppGenie, prefer SaaS (Software as a Solutions) for the hosting of mobile wallet backends. It saves us time and money for our clients.

Trending Mobile Backend as a Service (MBaaS) available in 2021 are listed below:

1. AWS Mobile

2. Kinvey

3. SashiDo

4. Kumulos

5. Google Firebase

Cost to build Mobile Wallet

The e-wallet mobile app development cost depends on many aspects like features, developers’ location, technologies you are implementing, and many more. However, your software development partner's geographical location will significantly influence the hourly cost of development.

The basic cost of the e-wallet app's development ranges between $25,000 to $50,000. Moreover, mobile wallet apps with high-end features will cost around $75,000 to $100,000.

Features that must be Incorporated Into Your Mobile Wallet App

1. Payments Between Bank Accounts

2. Intra-Wallet Payments in a Trice

3. Contactless Payment Technologies Integration Card Management

4. Seamless Onboarding

5. Rewards, Coupons, and Discounts

6. Bill Splitting

7. Bill Payments

E-Wallet App Development Process

1. Define whole concept of your wallet app

There are so many E-Wallets apps out there in the market. So, if you want to compete with those apps you should have a crystal clear vision of what type of mobile wallet app you want to have.

- Does your mobile wallet app resolve customers' pain points?

- Why will users opt your app over your competitors?

- What makes your app unique from the competition?

2. Analyze the Present Scenario of Market

Although, it is very important to know the type of mobile wallet app you want to develop, you should also identify the existing players in the tech market and their unique strategies. If you want to obtain desired goals it is advised to follow SWOT analysis. SWOT stands for Strength, Weaknesses, Opportunities, and Threats. By conducting this analysis you can easily compare your concept of the app and strategies with your competitors.

Also read: E-wallets 2021 Trend, Types of E-wallets, and Challenges.

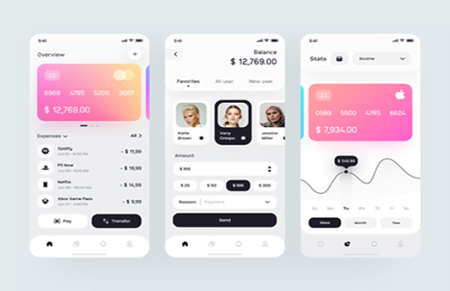

3. Design UI/UX

Directly starting designing the user interface and experience without doing mockups may sound quite good. But it is never a good practice to do this at the time of development of a mobile wallet app.

Mockups help you in identifying the user flow and all other possible user journeys.

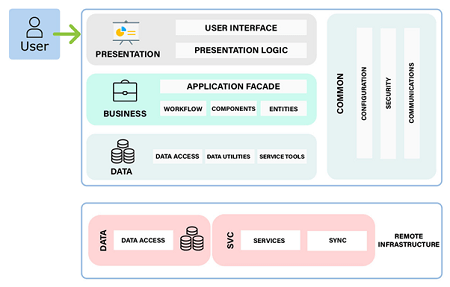

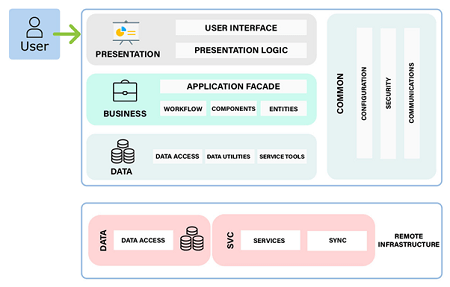

4. Develop the Wallet App by Designing Technical Architecture

Authentication process is very important for every Mobile wallet because apps require it to be robust and highly available. Technical architecture consists of programming language, technologies, database structure, innovative features and UI/UX. Following illustration will help you understand technical architecture better.

When you are done building the technical architecture, developers start to set the development environment for your mobile wallet backend.

Technologies like HTML, CSS, and JavaScript are used for front-end development. In this phase, developers replicate the design created in .psd or .xd format.

5. Testing

Last but not least, testing is a core of every mobile app development process. The quality analysts check the final code written by the developers . After checking, they send the errors back to the developers to resolve the issues and make the app bug-free. The wallet app can be uploaded to the app stores only after receiving final approval from the testing team.

Conclusion

Now you know every important aspect of creating a wallet app for Android and iOS, it’s time to elect whether you should develop it yourself or hire an experienced FinTech developer.

I have one article that will surely help you decide this: Click here to read the guide.

Also Read: How to Find the Right Mobile App Development Company?

Divya is an outstanding writer at Nimble AppGenie. She is very innovative with her creative ideas. She is very passionate with technology implementation in several industry verticals and always keen to learn new opportunities that brings business efficiency and profitability.

Whereas, Nimble AppGenie is an expert in developing solutions for Healthcare, FinTech, and EdTech. Nimble AppGenie is helping small-large scale enterprises by providing innovative solutions that excel in the market.

Post new comment

Please Register or Login to post new comment.