A majority of the earning citizens in India are concerned about tax planning and seek to find ways to reduce tax liability. ELSS Mutual Funds like Tata India Tax Savings Fund g have allowed investors to enjoy the tax benefits up to a certain limit along with the capital gains on the invested amount. Tata India Tax Savings Fund is among the oldest schemes in the category of tax saving mutual funds. Let’s find out how can an investor turn tax savings into wealth creation.

What Is Tata India Tax Savings Fund?

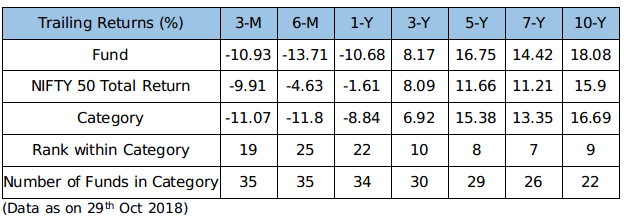

It is a tax saving mutual fund which was launched in March 1996 and has allowed many investors to gain wealth and reduce the tax liability. The fund has produced an annualised return of 18.68% since inception while the long-term trailing returns are also impressive. The benchmark and category average have been beaten by it many times in the past. The fund buys stocks with strong growth potential and high capital efficiency. Majority of the corpus is invested in large-cap stocks while nearly 25% of the corpus is invested in small and mid-cap stocks. The performance of Tata India Tax Savings Scheme has been full of ups and downs in the last few years. The portfolio consists of higher growth-oriented mid and small-cap stocks as compared to the peers.

How Much Tax Can be Saved?

With ELSS mutual fund, investors can reduce the tax liability by up to Rs 46,800*. As per the norms of Section 80C of ITA, a maximum of Rs 1.5 lac per year can be reduced from the taxable income. As a result, the tax liability will be calculated on the reduced amount after investment. Suppose if a resident of India, earning 12 LPA, invested Rs 1.5 lac as a lumpsum in Tata India Tax Savings Fund 5 years ago, he would have reduced the tax liability by Rs 46,800*. Apart from that, his investment would have been valued at Rs 3.3 lac. In this way, an investor can create surplus wealth every year and reduce the tax liability at the same time.

Who Should Invest?

Tata India Tax Savings Fund is suitable for the investors who can take high risk as the fund has shown standard deviation of nearly 17% in the last 3 years and Beta is also higher than the category average. Although the risk to reward ratio is in a better position, but the fund has a high-risk portfolio and higher influence of small-cap stocks. However, SIP for the long term can yield much higher returns than most of the peers in the category. New investors should consult with a financial advisor before investing in this scheme as it may not suit many of the investors.

Tata India Tax Savings Fund Growth has assisted thousands of investors in tax planning and has provided consistent returns in the past. The fund can be trusted to perform well in the future as well due to experienced management staff and supportive market conditions. According to the current market conditions, it is the right time to buy or make an additional purchase in the fund.

It is the most beneficial method to reduce the tax liability and earn wealth appreciation in the long term. Although the lock-in period of the fund is 3 years but the investment can be kept for longer duration for better outputs.

The article describes why Tata India Tax Savings Fund is a smart solution for tax planning concerns as it also provides significant wealth appreciation.

Dishika baheti is a financial writer associated with MySIPonline who is an expert in analysing the mutual fund schemes. She gives unbiased opinions regarding tax saving funds.

Post new comment

Please Register or Login to post new comment.